Learn more about how the products work

How it works in detail

Finding the right investment is often not easy. This is especially true in times of low interest rates and in sideways trend for stock markets. A look at alternatives can therefore be worthwhile.

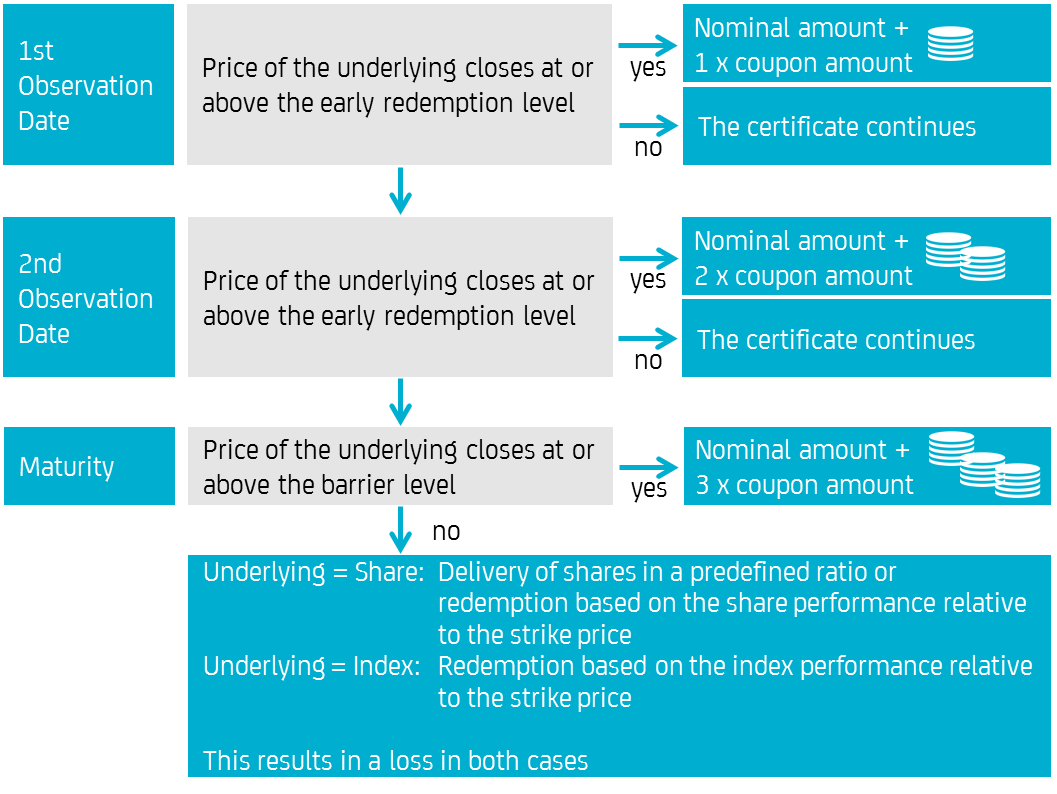

An Express Plus certificate from UniCredit onemarkets usually refers to a share or a share index. During the term, early redemption with positive income is possible on regular key dates (express). This is the case if the price of the underlying on the respective observation date closes at least on a price set at the start of the term (early redemption level).

If there is no early redemption, at the end of the term the integrated barrier partially protects against falls in the price of the underlying and ensures the repayment of the nominal amount. The barrier level is determined at the beginning of the term.

Express Plus Certificates are aimed at investors who assume that the price of the underlying will rise slightly during the term and will not fall below the barrier at the end of the term.

You can find our range of Express Plus Certificates here:

Chances

- Regular chance of repayment with positive return.

- At the end of the term, the barrier partially protects against falls in the price of the underlying and ensures the redemption of the nominal amount.

Risks

- The investor is exposed to the risk of share price movement.

- The earnings opportunity is limited to payment on the respective redemption dates.

Redemption at maturity

If there is no early redemption of the nominal amount, there are two scenarios at the end of the term.

- If the price of the underlying is at least equal to the earnings barrier at the end of the term, investors receive a repayment of the nominal amount including income.

- If the underlying price is below the barrier, shares are either delivered or repaid in accordance with the actual share price development. In the case of indices repaid in accordance with the actual index development. In both cases, the value can be significantly lower than the initial selling price of the express certificate, price losses are possible.

In the event of bankruptcy, i.e. over-indebtedness or insolvency of the issuer, there may be losses up to total loss of the invested capital.

The following graphic shows an example of the redemption profile of a HVB Express Plus Certificate.