Resolution of banks and creditor participation

Note on resolution of banks and creditor participation (bail-in)

In response to the 2008 financial crisis, many countries adopted regulations that will enable banks at risk of default to be resolved in an orderly manner without the need for help from taxpayers. This means that bank shareholders and creditors can be involved in their losses in the event of liquidation. The aim of these regulations is to enable banks to be resolved without using public funds.

To this end, the European Union has adopted the following acts:

- The bank recovery and resolution directive (the BRRD) and

- The Regulation establishing uniform rules and a uniform procedure for the resolution of credit institutions and certain investment firms in the framework of a Single Resolution Mechanism and a Single Resolution Fund (the SRM Regulation).

The BRRD states, among other things, that each EU member state will set up a national resolution authority that has certain rights to resolve and recover credit institutions. These measures may have adverse effects on bank shareholders and creditors.

The exact nature of the measures at a national level that resolution authorities can take may vary in detail. In the following, we explain the possible resolution measures using Germany as an example. The resolution procedures of other countries, especially non-European countries, may also be different and even more substantial.

When might I be affected?

You might be affected as a shareholder or creditor of a bank, i.e. if you hold financial instruments issued by the bank (e.g. shares, bonds or certificates), or as a contractual partner of the bank if you have claims against the bank (e.g. individual transactions under a framework agreement for financial futures transactions).

The securities that your bank holds for you, as a client, in a custody account and that have not been issued by the custodian bank are not the subject of a resolution measure against this bank. If a custodian bank is undergoing resolution measures, your ownership rights to these financial instruments in the custody account are not affected.

Who is the resolution authority?

Resolution authorities have been created in order to enable orderly resolution in the event of a crisis. The resolution authority responsible for the bank concerned is authorised to order resolution measures under certain conditions.

The Single Resolution Board (the SRB or Einheitlicher Abwicklungsausschuss in Germany) and the Federal Institute for Financial Services Supervision (Bundesanstalt für Finanzdienstleistungsaufsicht — BaFin) are the resolution authorities responsible in Germany. For reasons of simplification, the following discussion does not distinguish between the SRB and BaFin.

When will a bank resolution or creditor participation occur?

The resolution authority may order certain resolution measures if all of the following conditions are met:

- The survival of the bank concerned is at risk. This assessment is made according to legal requirements and will apply, for example, if the bank's losses means that it no longer meets the legal requirements for authorisation as a credit institution.

- There is no prospect of the bank's default being averted by alternative private-sector measures or other regulatory measures.

- The measure is necessary in the public interest, i.e. necessary and proportionate, and liquidation as part of a regular insolvency procedure is not an equivalent alternative.

What measures can the resolution authority take?

If all the conditions for resolution are met, the resolution authority can take extensive measures, even before insolvency, which can have a negative impact on shareholders and creditors of the bank, such as:

- Bail-in (also known as creditor participation): The resolution authority may either write off financial instruments and claims against the bank in part or in full or convert them into equity (shares or other equity participation in the company) in order to stabilise the bank.

- Sale of the company: The shares, assets, rights or liabilities of the bank to be resolved are transferred in whole or in part to a specific buyer. Insofar as shareholders and creditors are affected by the sale of the company, another existing institution will be made available to them.

- Bridge bank: The resolution authority may transfer shares in the bank or part or all of the bank's assets, including its liabilities, to a bridge bank. This may affect the bank's ability to meet its payment and delivery obligations to creditors and reduce the value of the bank shares.

- Transfer to an asset management company: Assets, rights or liabilities are transferred to an asset management company in order to manage the assets with the aim of maximising their value until later sale or liquidation. Similarly to the sale of a company, creditors will have a new debtor after transfer.

The resolution authority may officially order adjustment of the terms of the financial instruments issued by the bank and the claims against it, e.g. the due date or the interest rate may be changed to the disadvantage of the creditor. Furthermore, payment and delivery obligations may be modified, including temporary suspension. Creditors' termination and other decision-making rights resulting from financial instruments or claims may also be temporarily suspended.

Under what circumstances am I affected by a bail-in as a creditor?

Whether you, as a creditor, are affected by the bail-in depends on the scope of the measure ordered and on the classification of your financial instrument or claim. Within the framework of a bail-in, financial instruments and receivables are divided into different classes and drawn upon according to a legal order of precedence for liability (liability cascade).

The following principles apply to the involvement of shareholders and creditors of the respective classes: Only when a class of liabilities has been drawn upon in its entirety but is not sufficient to compensate adequately for losses to stabilise the bank can the next class of liabilities in the liability cascade be written off or converted.

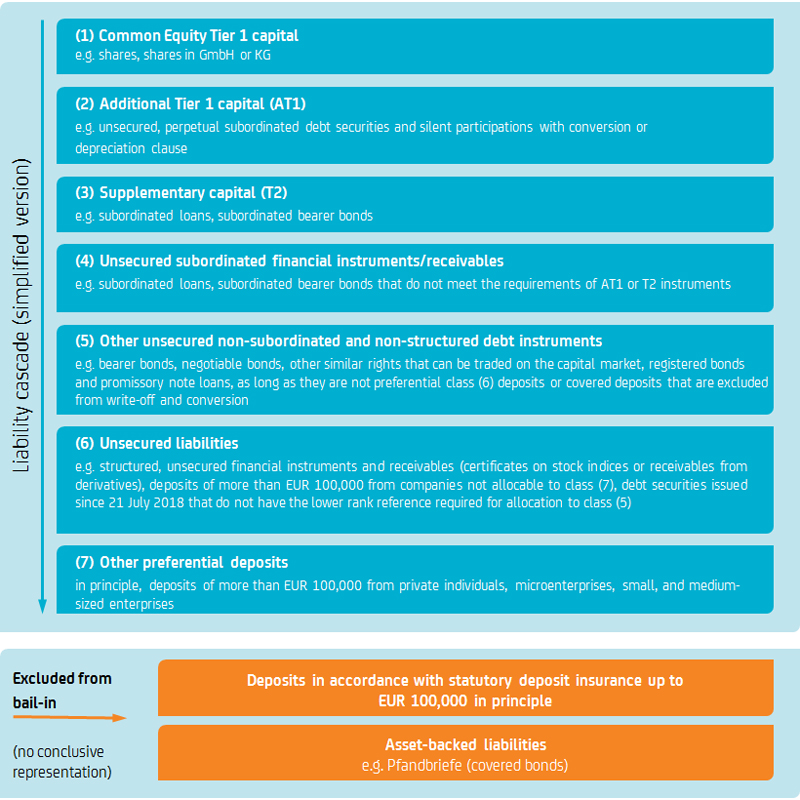

Certain types of financial instruments and receivables are exempted from bail-ins by law. For example, deposits covered by the statutory deposit guarantee scheme up to EUR 100,000 and asset-backed liabilities (e.g. Pfandbriefe [covered bonds]).In the liability cascade of a bank established in Germany, a distinction must be made between the following classes:

1. Firstly, the resolution measures affect common equity tier 1 capital and thus the bank's owners.

2. Thereafter, the creditors of the additional tier 1 capital are called on (holders of unsecured perpetual subordinated debt securities and silent participations with conversion or depreciation clauses, which are subordinated to supplementary capital instruments).

3. Subsequently, the supplementary capital is drawn upon. This affects creditors of subordinated liabilities (e.g. holders of subordinated loans).

4. Next in the liability cascade are the unsecured subordinated financial instruments and receivables that do not meet the requirements for additional tier 1 capital or supplementary capital.

5. These are followed in the liability cascade by unsecured non-subordinated financial instruments and non-structured debt instruments1. This class only includes debt securities that

a) were issued before 21 July 2018 and do not constitute money market instruments or structured products; or

b) have been issued since 21 July 2018, have a contractual term of at least one year, do not constitute structured products and where the contractual terms and, in the case of an obligation to publish a prospectus, the prospectus expressly note that they rank below the liabilities of the following class (6).

This class is also referred to as "non-preferential non-subordinate" (or senior non-preferred).

6. The next level in the liability cascade includes the following unsecured liabilities:

a) Debt instruments not allocable to class (5), for example debt instruments issued since 21 July 2018 and that do not have the lower rank reference required for classification in class (5).

b) Structured, unsecured financial instruments and receivables (such as certificates on stock indices or receivables from derivatives). In such cases, the amount of the repayment or interest payment depends on an uncertain future event or settlement is effected in a manner other than by payment of money.

c) This also includes deposits of more than EUR 100,000 from companies not allocable to class (7).

Unlike class (5), this class is also referred to as preferential non-subordinate (or senior preferred).

7. Finally, deposits from private individuals, microenterprises, small, and medium-sized enterprises may also be drawn upon to the extent that they exceed the statutory guarantee of deposits of EUR 100,000 (other preferential deposits).

The simplified order of liability shown on the last page (in the direction of the arrow starting with the common equity tier 1 capital) therefore applies, whereby a lower class is only drawn upon to cover the losses if drawing upon the preceding classes is not sufficient (see point (Liability cascade simplified presentation)").

The resolution authority may deviate from this principle in individual cases.

1 Debt instruments are bearer bonds, negotiable bonds and similar rights that, by their nature, can be traded on the capital market, and registered bonds and promissory note loans, insofar as they do not qualify as preferential deposits in class (6) or as covered deposits that are excluded from write-off and conversion.

What consequences can the resolution measures have for me as a creditor?

If the resolution authority orders or implements measures under these rules, the creditor may not terminate the financial instruments or claims or assert any other contractual rights solely on the basis of this measure. This applies as long as the bank fulfils its principal obligations under the terms of the financial instruments and receivables, including payment and performance obligations.

If the resolution authority implements the measures described, it is possible that the invested capital of the shareholders and creditors be lost in its entirety. Shareholders and creditors of financial instruments and receivables may therefore lose the entire purchase price they spent on the acquisition of financial instruments and receivables as well as other costs associated with the purchase.

The mere possibility that resolution measures may be ordered can make it difficult to sell a financial instrument or a claim on the secondary market. This may mean that shareholders and creditors are only able to sell the financial instrument or the claim at significant discounts. Even in the case of existing repurchase obligations of the issuing bank, a significant discount may be incurred on the sale of such financial instruments.

If a bank undergoes resolution procedures, shareholders and creditors should not receive worse treatment than that as part of normal insolvency procedures of the bank. However, if the resolution measure leads to a shareholder or creditor being in a worse position than it would have been as part of regular insolvency proceedings against the bank, the shareholder or creditor is entitled to claim for compensation against the fund set up for resolution purposes (restructuring fund or Single Resolution Fund, SRF). Should a claim for compensation arise against the SRF, there is a risk that the resulting payments will be made much later than would have been the case if the bank had duly fulfilled its contractual obligations.

Note according to Article 41(4) of the Delegated Regulation (EU) 2017/565 of 25 April 2016

Certain financial instruments issued by credit institutions and investment firms are designed to meet regulatory capital requirements under Regulation (EU) No 575/2013, Directive 2013/36/EU and Directive 2014/59/EU.

This includes, in particular, the common equity tier 1 capital, additional tier 1 capital or supplementary capital instruments issued in classes (1)–(3), the subordinated financial instruments and receivables described in class (4) and the non-preferential debt instruments classified in class (5).

These instruments typically have a higher return than bank deposits, but bear a higher risk of default in the event of insolvency or if resolution measures are implemented due to the lower rank and generally non-existent deposit guarantee. Unlike bank deposits, these instruments can generally be traded on a secondary market, but it is possible that a buyer or seller cannot be found on the secondary market (liquidity risk) and the market price can change to the disadvantage of the investor (price change rate risk).

For details on opportunities and risks, please refer to the product documentation of the specific financial instrument.

Where can I find out more?

The BaFin has published information on the resolution of banks and insurance companies and the potential loss-sharing of customers: